The past, present

and future of furniture eCommerce

Knowing the trends in eCommerce, and in particular, how furniture eCommerce has developed and changed is critical for retailers wanting to thrive in 2021. From the standpoint of early 2021, we aim to look back at the wreckage of 2020 and answer “what does the future of eCommerce really look like for retailers?”

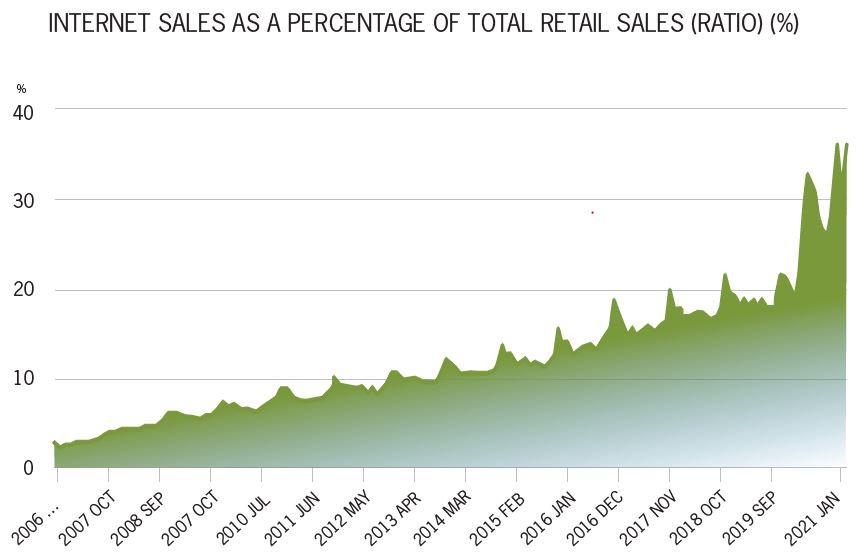

Starting with eCommerce generally, this graph shows how UK internet sales gradually evolved over the past fifteen years. Notice the steady increase each year with the peaks beginning to develop from 2009 in November.

One explanation for this is Amazon introducing the Black Friday buying bonanza in November 2010. Curiously there’s a plateau in November 2019 with no increase year on year. And then in Q2 and Q4 of the 2020 pandemic year - boom!

You can follow the link from chart and plot the numbers at each point. This is a summary of the percentages at three-year waypoints, each one taken at the November peak:

2006 2.8%, 2009 7.9%, 2012 10.7%, 2015 15.5%, 2018 21.6%, 2020 36.2%

Source: Office for National Statistics licensed under the Open Government Licence v.3.0 ONS

Demographic shifts

What's also consistently changing over the years are the demographics of eCommerce shoppers. A significant addition of furniture eCommerce revenue has been added by the over 65’s. Even before the pandemic without restricted movement outside the home, more than half of over 65’s were already shopping online. The ONS reported that in 2019, for the first time, more than half (54%) of adults aged 65 years and over-shopped online. (Source ONS: link)

So what does this mean for the future of the furniture industry, and, more specifically the future of furniture eCommerce? Will things ever be the same? And if not what are the tectonic shifts that will shape the peaks and troughs of the next decade?

15 years of furniture retail in 5 minutes

The furniture industry acts as a bellwether for other parts of the UK economy. What we spend on our home furnishings indicates a great deal about our feelings for the world around us. This spending also reveals and reacts to underlying social and economic trends like the growth in single occupancy households and the increase in rental accommodation. Even the pandemic led category demand spikes in areas like home office furniture have a precedent. For example, similar increases occurred when sustained rail strikes in 2016 prevented people from travelling into work.

So how do we make sense of the historical data? What do the trends indicate? What next after the uncertainties and disruptions we face now in this first year of the new decade. The global trauma that was 2020 is behind us. Does the prospect of a vaccine led recovery and pent up demand mean a roaring 2020’s is upon us?

Let’s look at the data.

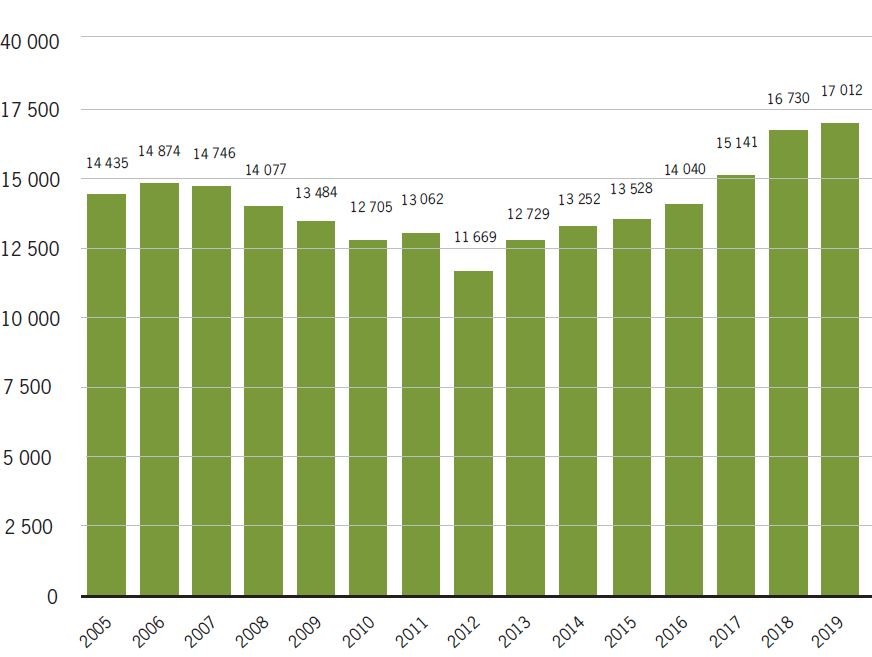

This bar chart shows how the total annual expenditure on furniture and furnishings in the United Kingdom fluctuates from 2005 to 2019. The latest figure, tantalisingly, is only for 2019, when UK households purchased approximately £17 billion worth of furniture and furnishings.

In this context furniture eCommerce as a phenomenon is informed by the results of the 2020 Statista Global Consumer survey. It reports that 21 percent of UK consumers were estimated to have bought furniture and household goods online in the last 12 months. And significantly 32 percent claim to mostly look online for information about these products. Relative to other categories of product there's room for growth in these numbers and that’s an opportunity for furniture eCommerce.

Graph: Annual expenditure (in million GBP) on furniture and furnishings in the United Kingdom (UK) from 2005 to 2019, based on volume.

Source: Office for National Statistics licensed under the Open Government Licence v.3.0

Current state of furniture retail eCommerce & stores

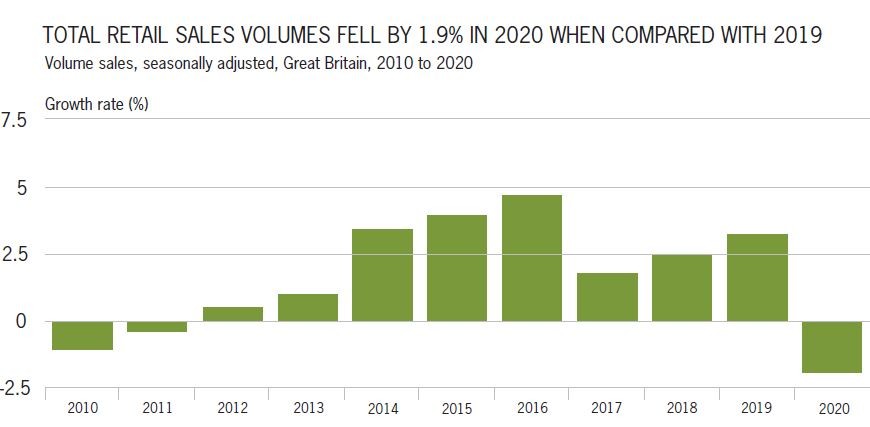

So where are we now? Retail overall has taken a body blow in 2020, no argument, and here’s the evidence in a bar chart from the ONS. The quantity bought in retail sales decreased by 1.9%, the largest annual fall since records began in 1997.

Effect of the pandemic

Drilling down into the detail of 2020 and the impact of the pandemic is expected to have mixed results on furniture, lighting and homeware retailers in the UK. We find the evidence for this is once again from the ONS in their retail sales index. They report the downside was in April 2020 when demand plummeted (year on year) by 78.7% and by 64.5% in May 2020.

However, on the up side trading is seen to recover soon after. Up by 11.8% in July 2020 and 3.8% in August 2020, compared with the same months in 2019. This is because of pent-up demand and people getting used to social distancing measures. So how does this inform the picture?

We can't argue with the record annual declines in sales volumes in 2020 when compared with 2019. But it’s such a “black swan” year that record annual decline sits alongside another extreme and positive statistic. That is where total online retailing values saw an increase by 46.1% in 2020 in comparison with 2019. The highest annual growth reported since 2008.

So, whatever the yo-yo effect on retail sales of the lockdowns, the facts show that furniture eCommerce has the potential for a greater role to play. After all, UK furniture, bed and furnishings manufacturing and retailing remains a substantial and important industry employing over 339,000 people. And we know that in 2019 expenditure on furniture and furnishings reached a high of £17 billion. That’s a sizable market to be going after, and you only need a small percentage share of that to thrive.

Source: Office for National Statistics licensed under the Open Government Licence v.3.0

The future of furniture eCommerce…

Revenue in the online home furnishing retailing industry in the UK will benefit from growing demand for online shopping over the next five years. The surge in eCommerce during the pandemic and the trend for increased online purchasing by all age groups will fuel this growth.

The forecast for 2021 is a sharp rise in demand as more people turn to online retailing to make purchases through furniture eCommerce websites. This rosy picture extends over the next five years. IBISWorld, a research company, predicts furniture eCommerce revenue in the UK increasing at a compound annual rate of 11.2% to £2.7 billion. Compare that with the annual growth rates for all types of retailing (from stores and online), that range from between 1.5% and 3.5% per year, and furniture eCommerce looks like a sound investment.

So what does the combined future of furniture eCommerce and bricks and mortar furniture retail look like? Here’s five key themes to think about and look into:

1. Innovate your physical space

Train your shop floor staff to be responsive to eCommerce customers. Rethink the layout to include tablets and computers for interactive tools and buying guides. See our furniture case studies here

2. Be mobile friendly

Device access to eCommerce websites is dominated by mobile smart phones so having a mobile friendly website is a must. Even tablet browsing at home will take advantage of mobile friendly websites.

3. Unified retail management systems

If your IT ecosystem is characterised by multiple legacy systems held together with some string and a rubber band then you need to understand how a Unified Commerce platform will deliver your Omnichannel ambitions. See our blog post on this here

4. Online marketplaces

These offer a means to get greater visibility and exploit the Omnichannel opportunity. Look outside the obvious ones like eBay and Amazon for more exclusive and margin-healthy niches

5. Enhancing visual communication

Essential to bridging the gap between the online and in-store shopping experience. Start with high quality graphics combined with 3D product modelling to deliver augmented reality. Cost-wise these options are increasingly affordable and in reach. See our blog post on this here

And this 3D service company, a USA company with a UK office

Contemplating change

Retail and furniture eCommerce never stand still and the only constant is change. These are truisms. The pandemic year of 2020 represents an extreme example of how change has been forced on to people and businesses, and under circumstances beyond normal control. Over the past 18 months estimates show that shopping online has accelerated it’s rate of growth to the point that it’s advanced by at least five years. It remains to be seen if that boost is sustainable but clearly the changing trends in shopping habits have become better understood and more widespread.

Wayne Robbins, Director, Iconography

We’ve had some great feedback from our leading furniture eCommerce clients on just how well their websites have performed. A number have told us that 2020 fast tracked them several years in terms of the contribution online sales now make to their business.

Omnichannel retail without compromise

We've created a fantastic system, and we're proud to say it's won some recognition for Best Use of Multichannel

(eCommerce Awards 2019 Winner)

Business to Business

A variety of trade focussed functionality, from purchase orders, automated replenishment, to multi-warehousing and powerful reporting.

Read MoreCore eCommerce

A fully responsive, high converting, enterprise level eCommerce and eBusiness platform – crafted by a dedicated in-house team of digital artisans.

Read MoreUnified Commerce

Our cloud-based omnicommerce retail solution is getting some recognition and was announced as a winner at the eCommerce Awards 2019!

Read More3rd March 2021